What Does How To Form A Llc Mean?

A lot of banks need you to have an EIN prior to you can open a service account. Depending upon the nature of your company, you will likewise need to obtain a local, state, or federal service license. For example, if your business offers alcohol or guns, then you will require a federal, state, and/or business license.

Other cities, such as Chicago, require special licenses for company activities such as retail, dining establishments, entertainment venues, theaters, daycare, manufacturing centers, and motor lorry service center. You wish to appropriately capitalize your LLC with funds sufficient to run business, and you want to ensure that the LLC account is different from your individual accounts.

Anticipate that the bank will want to see your filed Articles of Organization, your EIN, and potentially resolutions of the LLC licensing the opening of the account. You will require to designate who has finalizing authority, and whether 2 signatures will be required for big check out a defined quantity.

The Greatest Guide To How To Form A Llc

It shows the names and addresses of the LLC owners (members), what class of units they hold, how many units they hold, and when these units were obtained. The Membership Ledger also tapes the transfer of units by celebrations and the dates of transfer. It's essential to keep the LLC Subscription Journal approximately date.

Missing the deadline for such filings can lead to charges and late fees, and even suspension or dissolution of the LLC. As you begin to do service in other states, ensure you make any required state or local filings in those brand-new jurisdictions. If the information in your LLC filings changes (such as service name or organisation address), ensure to appropriately amend your filings.

Rules for forming an LLC vary by state. Consider drafting an operating contract detailing each member's functions, rights, responsibilities and portion of ownership. It might be recommended to have a lawyer evaluation your documents to safeguard your interests. A restricted liability company, or LLC, is comparable to a collaboration however has the legal protections of personal possessions that a corporation provides without the burdensome formalities, documents and costs.

A Biased View of How To Form A Llc

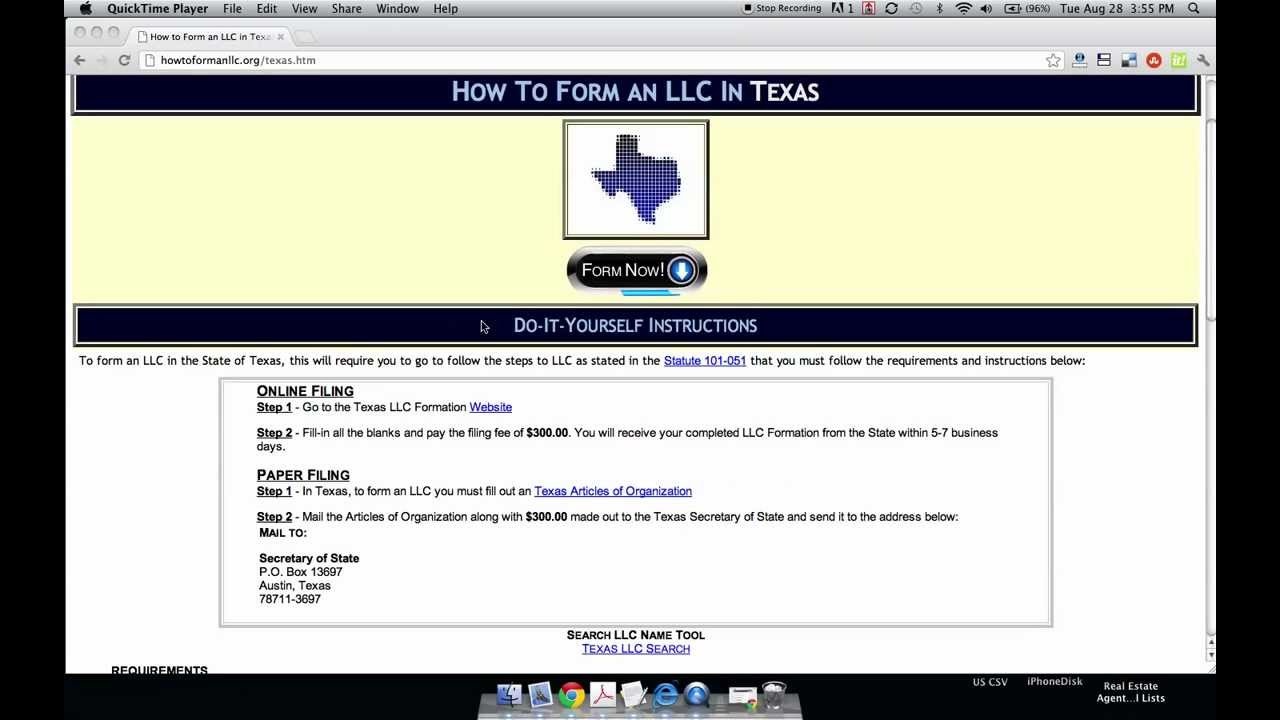

All new LLCs need to file so-called articles of organization with their secretary of state's office. This is usually simply a short form that requests the names of the LLC and its members and their contact details. The filing cost can vary from $30 to $200. A few states also have other registration requirements.

Or use Discover Law's online guide to state corporations workplaces. Though it's often not needed by law, you ought to draft an operating arrangement for your LLC that spells out the details of the company arrangement, consisting of members' portion ownership, roles, rights and responsibilities. Having such an arrangement can help secure the LLC structure if it's challenged in court and prevents you from needing to default to state operating guidelines.

But it's a good idea to have one read over paperwork and your operating agreement to ensure your interests are safeguarded. Although a lot of states do not require any annual paperwork or administrative procedures, you ought to document major business proceedings and lay out some formal procedures-- like one meeting a year-- to assist secure your LLC status.

Indicators on How To Form A Llc You Need To Know

Among LLC advantages: pass-through taxation-- meaning the profits and losses "travel through" business to the people owning the business who report this info by themselves individual income tax return. The outcome can be paying less in taxes, given that earnings are not taxed at both business level and the personal level.

California, for example, charges an annual $800 LLC tax together with a $900 to $11,760 annual charge based upon a service's overall yearly earnings going beyond $250,000. In a lot of cases that does not need to be a member or manager. In some states, the registered agent's consent to serve as signed up agent is likewise needed. Once authorized check my blog and submitted, the state will release a certificate or other confirmation file. The certificate acts as legal evidence of the LLC's status and can be used to open a company checking account, Certificate of Great Standing is frequently required too.

Many aspects are utilized to determine whether a company is transacting business in a state, and for that reason needs to foreign qualify. Some of the common criteria include whether your company -has a physical presence in the state has employees in the state accepts orders in the state Note that different states have different requirements.

Everything about How To Form A Llc

Additionally, an LLC might use several classes of subscription interest while an click over here S corporation might only have one class of stock. Visit our post on LLCs versus S corporations to discover other key differences. What LLC Kinds are needed to start a minimal liability company?Articles of Company, sometimes also called a Certificate of Company, should be prepared and filed with the state.

If your LLC is formed through Biz Filings, all you require to do is complete our easy LLC types and we will do the rest. We will prepare and submit your Articles of Organization and LLC forms and pay the preliminary filing costs in your place. Who can form an LLC?Typically, there are no residency or legal limitations as to who can begin an LLC.

![]()

To find out more regarding the requirements of each state, view the LLC Formation Requirements page of our state guides. Do I need a lawyer to form an LLC? No, you can prepare and file the Articles of Company-- among the most essential LLC types required-- yourself.